To qualify for an amortization period of up to 50 years, the property will need to meet certain commitments, such as having a certain percentage of units being accessible, or for the building to beat certain energy efficiency thresholds. The other 30% or less can be mixed-use, such as for retail space. To be considered residential, at least 70% of the property’s floor space or loan value must be residential. It can calculate the installment amount that will be paid back to the financial institution.

This includes properties offering student housing or retirement housing. Business Loan Calculator is a subset of loan repayment calculators. For example, if you have a factor rate of 1. If using excel, you can calculate the monthly payment with the following formula: PMT (r, n, P). Lenders will multiply the factor rate by the principal to determine how much you pay back. For example, the LTV for a 300,000 property with a 200,000 loan would be 66.67. LTV is calculated with the formula below: LTV Loan amount / purchase price or appraised value.

#Commercial loan calc how to

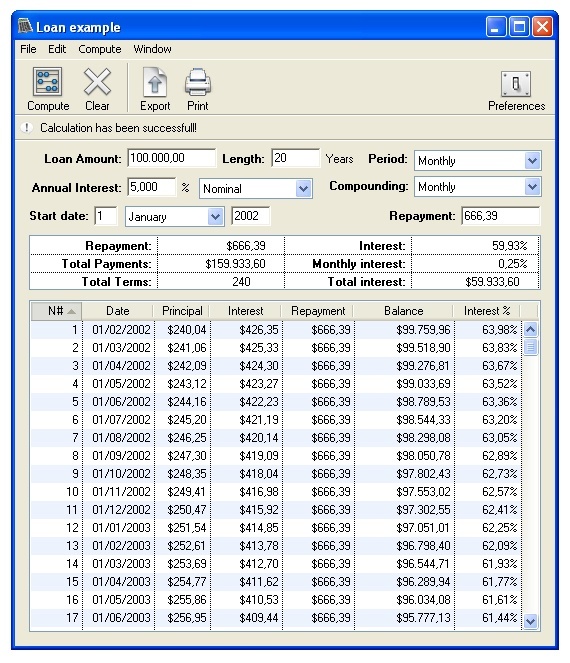

Multi-unit rental properties need to be residential in order to qualify for CMHC insurance. How to Calculate Monthly Payments for Commercial Loans Use the formula in the image below to calculate the monthly payment for a commercial loan. This is a percentage that measures the value of the loan against the value of a property.

#Commercial loan calc free

Otherwise, the maximum amortization period is 25 years for commercial mortgages in Canada. Try our free mortgage calculators to find out how much home you can afford, how much you could borrow and calculate your monthly loan payments with U.S. CMHC’s standard multi-unit loan insurance for rental properties allows a maximum amortization of 40 years. You can have an amortization period of up to 50 years with CMHC-insured commercial mortgages for eligible properties with CMHC MLI Select.

The business can use the loan for buying equipment or paying their staff.Ĭommercial construction loans are used to finance the construction of a building, an apartment, or a multi-family real estate investment.Commercial Mortgages with 50-Year Amortization To be honest, I should choose a water system domain force to synthesize a new moon body. sabal small commercial loan 'Kan refers to water. Term loans are another type of commercial loan where the business pays monthly payments just like any other loan. Calculates repayments for any type of commercial property mortgage, business loan or asset finance Calculates interest. average interest rate small business loan. Quickly see how much interest you could pay. Instead of a lump sum payment, the company can draw funds from the line of credit whenever needed. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. There are many different types of commercial loans, such as commercial real estate loans, business lines of credit, term loans, commercial construction loans, and many others.Ī commercial real estate loan is used to finance the purchase of a commercial property.Ī business line of credit is like a credit card for business. If you have any trouble understanding any of the fields, hover over the field for a description of the value requested. Here you can calculate your monthly payment, total payment amount, and view your amortization schedule. Most commercial loans are short-term loans, which can be anywhere from 3 - 7 years. Commercial Mortgage Calculator Welcome to our commercial mortgage calculator. But it doesn’t include some fees that your lender may charge. At least one year in business for online lenders and at least two years in business for banks. This calculator includes some of the core elements of an SBA loan, including your monthly principal and interest. Investors or business owners can use the commercial loan calculator to generate a business loan amortization schedule for business loans.Ī commercial loan is a loan agreement between a business and a bank. Follow these steps to get a commercial business loan.

0 kommentar(er)

0 kommentar(er)